Bookkeeping can be a headache for big and small business owners. The process of recording all financial transactions is often challenging and stressful, as there are many other important day-to-day tasks for startup business owners to handle. It's easy to put bookkeeping and other back-office tasks on the back burner.

Luckily, accounting and bookkeeping don't have to be the business owner's responsibility anymore. It's becoming more and more common for businesses to outsource bookkeeping to take care of the pesky task of handling financial transaction records.

An outsourced bookkeeper is a person or company that will perform your bookkeeping tasks out of office. Oftentimes, a bookkeeping service is essential for business growth and health. It leaves room for everyone in-office to be solely focused on their own tasks and can eliminate the cost of an in-house bookkeeping team.

Essentially, you'll give a third-party bookkeeper access to important financial information like bank statements, payroll, tax documents, and your accounting software. They'll take it from there, generating financial reports, ensuring your ledgers are up to date, and tracking money that goes both in and out of the company, among other essential tasks.

Outsourcing bookkeeping provides significant time-saving benefits by freeing up internal resources and streamlining financial processes. Businesses can focus on core activities while specialized firms handle time-consuming tasks like data entry, reconciliation, and reporting. This leads to greater efficiency, reduced stress, and more strategic use of time and energy.

Outsourcing bookkeeping is cost-effective and will save your company money. Experienced bookkeepers are often better at finding overdue clients and cuts your company could make to increase overall profit. Plus, having an outsourced bookkeeper is more cost-efficient in the first place, since you’re not technically their employer. You won't have to worry about their insurance, benefits, or training.

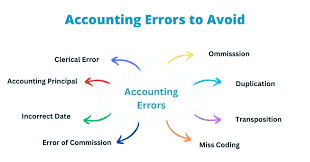

Having an outsourced bookkeeping service provider is known to reduce many common errors made by business owners. Modern bookkeeping is often done through a cloud-based automated system that allows you and other experts to view your records at any time, so there are many eyes on your books. This leaves little room for error, especially considering outsourced bookkeepers are highly trained, so there is no adjustment period needed. This can improve your peace of mind that your bookkeeping needs are being well taken care of.

Professional bookkeeping provides more in-depth financial reports than typical in-office bookkeeping. Because online bookkeeping uses virtual platforms, business owners can see their records anytime, including the cash flow and balance sheet.