Our primary duties include recording financial transactions, maintaining the general ledger, reconciling bank statements, credit card statements, creating invoices, generating financial statements like balance sheets and income statements, and ensuring the accuracy of all financial records by performing data entry and checking for discrepancies.

Inputting financial transactions into accounting software, including sales receipts, invoices, expenses, and payments.

This includes posting transactions, reconciling accounts, preparing financial statements, and ensuring accuracy, completeness, and compliance with accounting standards

Comparing and adjusting the balance of a company's cash account as recorded in its books with the balance reported by the bank on its bank statement. This ensures that the company's financial records accurately reflect its cash position. It involves identifying and correcting any discrepancies between the two balances

Generating invoices for customers with accurate details like product descriptions, quantities, and pricing to track income and ensure you get paid.

Tracking, managing, and collecting outstanding invoices to maintain healthy cash flow and minimize the risk of bad debt.

Managing invoices, verifying accuracy, recording payments, and making timely payments to maintain healthy vendor relationshipsand ensure efficient cash flow.

Recording purchase orders, purchase invoices, monitoring and tracking of inventory levels, etc.

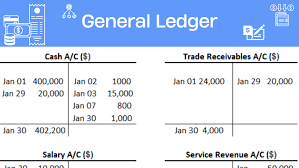

Generating reports like balance sheets, income statements, and cash flow statements based on recorded data.

Copyright 2025 - R.S Bookkeeping Services